MTN South Africa said on Monday that users of its MoMo mobile money platform can now “cash out”, or withdraw funds, at Nedbank ATMs.

The fees range from R10 for transactions of up to R1 000, R20 for transactions between R2 000 and R3 000 and R30 for transactions between R2 000 and R3 000, MTN said.

Users can also withdraw cash at retailers such as Pick n Pay, Shoprite, Checkers, OK Foods and USave.

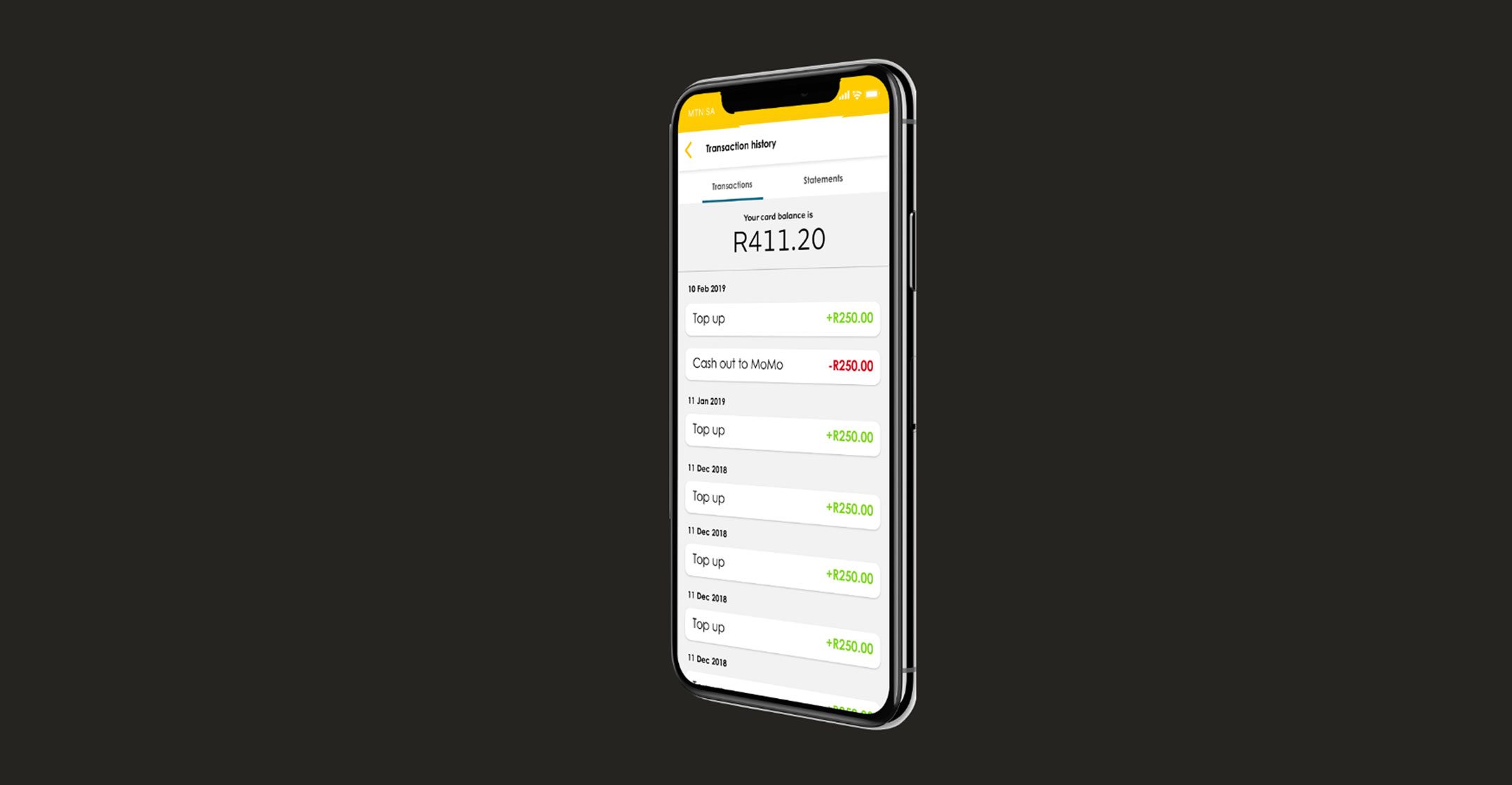

Felix Kamenga, chief officer for mobile financial services at MTN South Africa, explained that to draw cash, MoMo users log into the MoMo app (or use USSD), select “cash-out” and then withdraw cash at a Nedbank ATM or retail point of sale.

“After confirming the transaction, the voucher number will be displayed on the app/USSD and, in 15-20 minutes, customers will receive an SMS with a voucher number and a one-time Pin,” he said.

“Once the SMS is received, they can go to any Nedbank ATM or any of the participating retail stores, and at a Nedbank ATM would select the Nedbank cardless withdrawal option and follow the instructions.”

30-day validity

“At a participating retail store the client needs to inform the staff member at the till point that they would like to make a Nedbank cardless withdrawal. The cash-out vouchers are valid for 30 days.”

The service is only available between 7am and 6pm daily. This means MoMo customers will not be able to request a cash-out via Nedbank ATM outside of these times. TechCentral has asked MTN why this limitation exists and will update this article once feedback has been received.

“Cash-out vouchers are not transferable and, if the voucher is not used within 30 days, the funds less the fees are returned to the customer’s MoMo wallet,” Kamenga said.

For existing Nedbank Avo or Nedbank MobiMoney account holders, the funds are deposited into their Avo or MobiMoney wallets and they can then cash-out from that wallet. – © 2021 NewsCentral Media