Try our mobile app

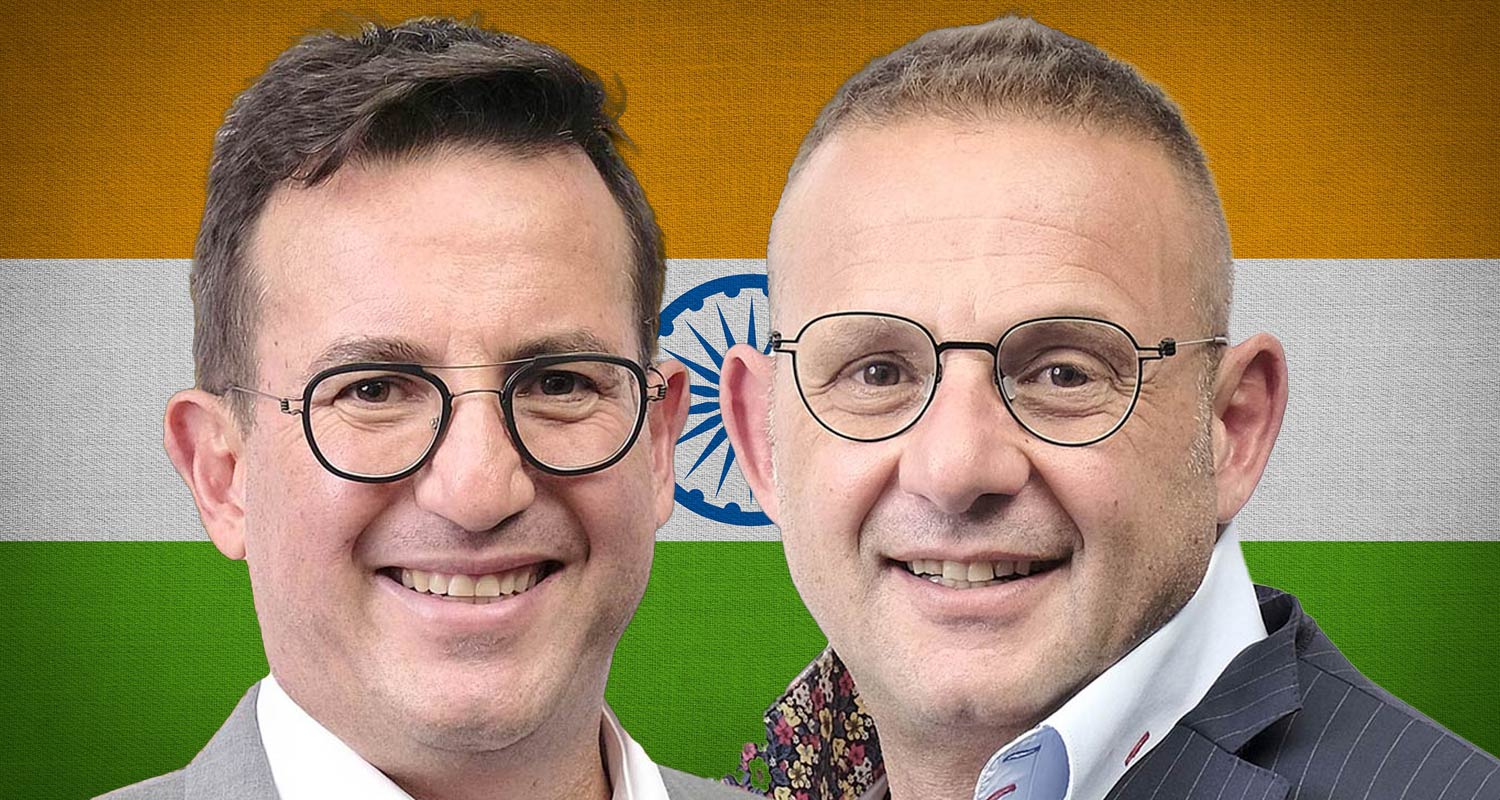

Mark Levy and Brett Levy, co-CEOs of Blue Label Telecoms Blue Label Telecoms co-CEOs, brothers Brett and Mark Levy, will personally have to cough up tens of millions of rands each, with the first of six instalments due next year, after the group’s plans to expand in India went awry. This comes after the Blue Label co-founders stood surety for their Indian business partner, in their personal capacities, in a deal involving the acquisition of shares previously held by Microsoft in fintech firm Oxigen Services India, the carrying value of which has since been written down to nil by the JSE-listed technology firm. The brothers now plan to pay off the money – as much as R63.8-million each – in annual instalments, with the first amount falling due in September 2025. Whatever the outcome of the board investigation, the brothers will still be liable for tens of millions of rand Neither of the pair plans to sell shares in Blue Label to fund this, and both hope the quantum of the figure will be reduced – pending an investigation by the group’s board and the advice of independent external legal counsel. Whatever the outcome of the board investigation, however, the brothers will still be liable for tens of millions of rand each in what both have admitted was, in hindsight, a terrible mistake. TechCentral became aware of the issue after raising questions about “loans to related parties” disclosed in notes accompanying the group’s recently published financial results for the six months ended 30 November 2023. The notes disclosed that the Levys owe Blue Label R63.8-million each, amounts that have risen from R53.9-million each as at 30 November 2022. Surety The loans have been disclosed in Blue Label’s financial reporting since 2018, but details about their nature are being reported on here for the first time. In an interview with TechCentral this week, the brothers explained that the loans related to surety provided more than a decade ago to Blue Label’s Indian business partner, Oxigen founder Pramod Saxena, to facilitate Saxena’s purchase of half of Microsoft’s 37.22% stake in Oxigen, a deal valued at US$10-million. Blue Label bought the other 50% of the Microsoft stake in the then-promising fintech start-up, but was not prepared the buy the entire stake from Microsoft. TCS | Levy brothers on the future of Blue Label and Cell C The Levy brothers had seen Oxigen as a big potential money spinner for the group, but despite being an early entrant in the Indian mobile digital payments market, the business failed to live up to its early hype. Oxigen found itself unable to compete with Paytm , part-owned by Alibaba Group’s Ant Financial, which significantly out-spent its smaller rival and built a commanding lead in the vast Indian digital payments market. Blue Label, unable to match the huge funding flowing into Paytm, was later forced to impair fully its investment in Oxigen. Although it remains a shareholder in the business, it appears unlikely it will ever recover its investment. According to the Levy brothers, Saxena didn’t have the funds available to pay the $5-million needed for his 50% share of Microsoft’s stake in Oxigen. The brothers then agreed to stand surety to Blue Label for the money, and did so in their personal capacities, not believing that the business could fail. At the time, it looked like a sure bet. “We shouldn’t have done what we did,” Mark Levy told TechCentral. “But no one gets married to get divorced.” We have never sold a share [in Blue Label], and we have no intention of selling any shares When the surety asset was triggered five years ago, following the decision to partially – and then, a year later – fully impair the asset, the Levys were then on the hook to Blue Label (or, technically, to Blue Label wholly owned subsidiary Gold Label Investments) for the $5-million. And the quantum involved has only escalated since then – more than doubling with interest and as a result of the sharp decline in the value of the rand against the US dollar. It’s now an eye-watering R127.6-million – R63.8-million for each co-CEO – according to Blue Label’s latest interim financial report. With the first of six annual repayments due next September, the brothers now hope that the quantum can be reduced – but admit it’s out of their hands. The board, working with external legal advisers, must now determine whether it’s fair for the brothers to be liable for all the interest payments and foreign exchange losses that have piled up over the past five years, and if not, what a fair amount would be. ‘We did it for Blue Label’ Mark Levy explained that neither he nor his brother benefited at all from standing surety for Saxena, and that the best outcome for the pair would be to settle Blue Label’s “real cost”. Saxena, he said, “was going to pull the whole deal if we didn’t help him. We didn’t want it to fail and for Blue Label not to get the equity [from Microsoft]. [The Blue Label board] wasn’t going to do it (buy the other 50% of Microsoft’s stake in Oxigen), so we looked to find a win-win…” Read: Blue Label formally moves to take control of Cell C According to Brett Levy, the Blue Label board was not prepared to stand surety for Saxena – or any other shareholder – and as a result the brothers decided to stand surety in their personal capacities to get the deal done. “We did it for Blue Label,” said Mark Levy. The two say they haven’t spoken to Saxena since Blue Label impaired its stake in Oxigen. The business continues to operate, and Blue Label still owns 58% of it. However, the JSE-listed firm never had an operational team on the ground – only attending board meetings and attending to other statutory requirements. “We are going to pay the price,” Brett Levy said of the money they now owe the company they co-founded. “This shouldn’t have happened. Our only request now to the [Blue Label] board is [to look at] the difference between the actual cost versus the costs on the account. Outside of that, there is nothing we can do.” He remains adamant that neither he nor Mark Levy – together, they hold just under 19% of the group’s equity – will be forced to sell shares to fund the settlement, no matter the final amount determined by the board. “We have never sold a share [in Blue Label], and we have no intention of selling any shares,” said Mark Levy. – © 2024 NewsCentral Media Get breaking news alerts from TechCentral on WhatsApp