General information

Country: UNITED STATES

Sector:

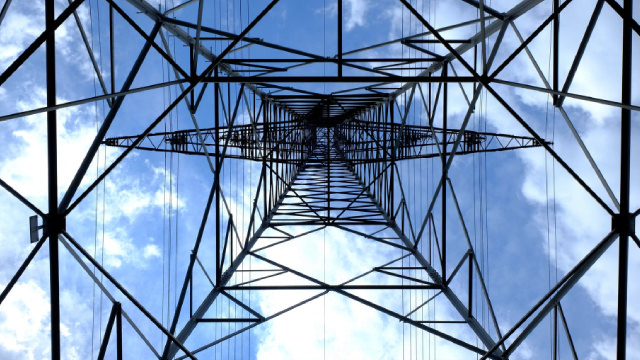

Utilities — Regulated Electric

PG&E Corporation, through its subsidiary, Pacific Gas and Electric Company, engages in the sale and delivery of electricity and natural gas to customers in northern and central California, the United States. It generates electricity using nuclear, hydroelectric, fossil fuel-fired, fuel cell, and photovoltaic sources. As of December 31, 2019, the company owns and operates approximately 18,000 circuit miles of interconnected transmission lines, 33 electric transmission substations, approximately 107,000 circuit miles of distribution lines, 68 transmission switching substations, and 760 distribution substations; and natural gas transmission, storage, and distribution system consisting of approximately 43,300 miles of distribution pipelines, approximately 6,300 miles of backbone and local transmission pipelines, and various storage facilities. It serves residential, commercial, industrial, and agricultural customers, as well as natural gas-fired electric generation facilities. The company was incorporated in 1995 and is headquartered in San Francisco, California. On January 29, 2019, PG&E Corporation filed a voluntary petition for reorganization under Chapter 11 in the U.S. Bankruptcy Court for the Northern District of California.

- Dividend yield for the last twelve months 0.7%

- Free cash flow yield -5.6% (LTM)

- Share price is 31.2% higher than minimum and 21.2% lower than maximum for the last 3 years

- The company is overvalued by EV / LTM EBITDA multiple compared to target level (12.2x vs )