Technology investor Prosus will pay up to US$144-million (R2.1-billion) in transaction fees when it buys a block of parent company Naspers’s shares, according to a document submitted to stock exchanges on 12 July, prompting criticism from investors.

The fees total more than Prosus’s free cashflow for the year ended 31 March, and are almost three times more than Naspers paid in 2019 to list Prosus on the Amsterdam Stock Exchange.

Some €95-million ($112-million) of the fees will be to cover securities transfer tax (STT), according to the document. The rest will be for costs such as fees for bankers, lawyers and accountants.

Prosus was spun out of Naspers in 2019 to hold the South African group’s international assets, including its 29% stake in Chinese tech giant, Tencent. Naspers hoped the move would reduce the discount its shares traded at to the value of its holding in Tencent. However, the discount kept widening.

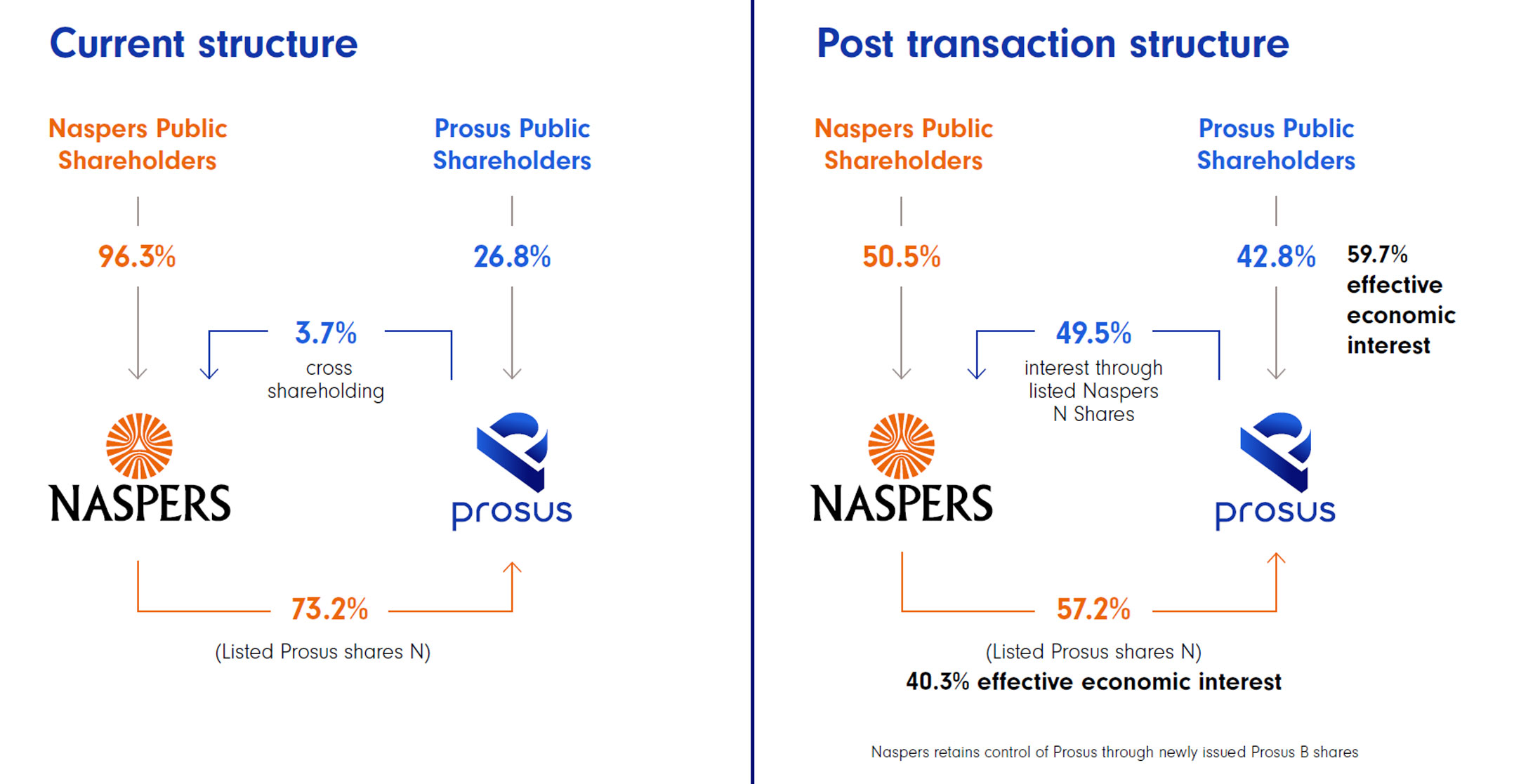

To try to address this, Prosus said in May it would issue new shares to buy up to 45.4% of Naspers in a share swap deal. The deal will move more of Naspers’s Tencent stake to Amsterdam from Johannesburg and, according to the two firms, help Naspers close the value gap to its Tencent stake because Prosus’s stock is more highly valued than Naspers’s. The deal will also increase Prosus’ free float on Euronext.

‘Less than 1%’

“The overall costs are less than 1% of the total value unlock that happens on day one as result of exchanging high-discount Naspers shares to lower-discount Prosus shares,” Prosus said via e-mail.

But some shareholders are unhappy with the costs after they had opposed the deal, saying it would create a complicated cross-holding structure that might actually increase the discount.

“I wouldn’t want to see such huge amounts of money being paid,” said Peter Takaendesa, head of equities at Mergence Investment Managers in South Africa. “It is quite material, especially if we are comparing the two transactions,” he said, referring to the fees paid during the listing of Prosus.

Mergence was among 36 fund managers from South Africa who wrote to Prosus’s management in June opposing the transaction.

In a shareholder vote on 9 July, the transaction won 90% backing, because over two-thirds of Prosus is held by Naspers. But up to 47% of outside shareholders in Prosus voted against it.

When Naspers listed Prosus in 2019, it paid €29-million to financial advisers, compared to the €20-million Prosus will pay them for the share swap, the document shows. Prosus notes the bulk of the fees are due to tax, but some investors said that was no excuse.

“When you’re doing a bad transaction, and a transaction that many shareholders have expressed a concern on, then any amount you pay is too much,” said Rajay Ambekar, CEO at Excelsia Capital, a Cape Town-based asset manager with shares in Naspers. “It is a real cost that shareholders are having to bear.” — Reported by Promit Mukherjee, (c) 2021 Reuters