Try our mobile app

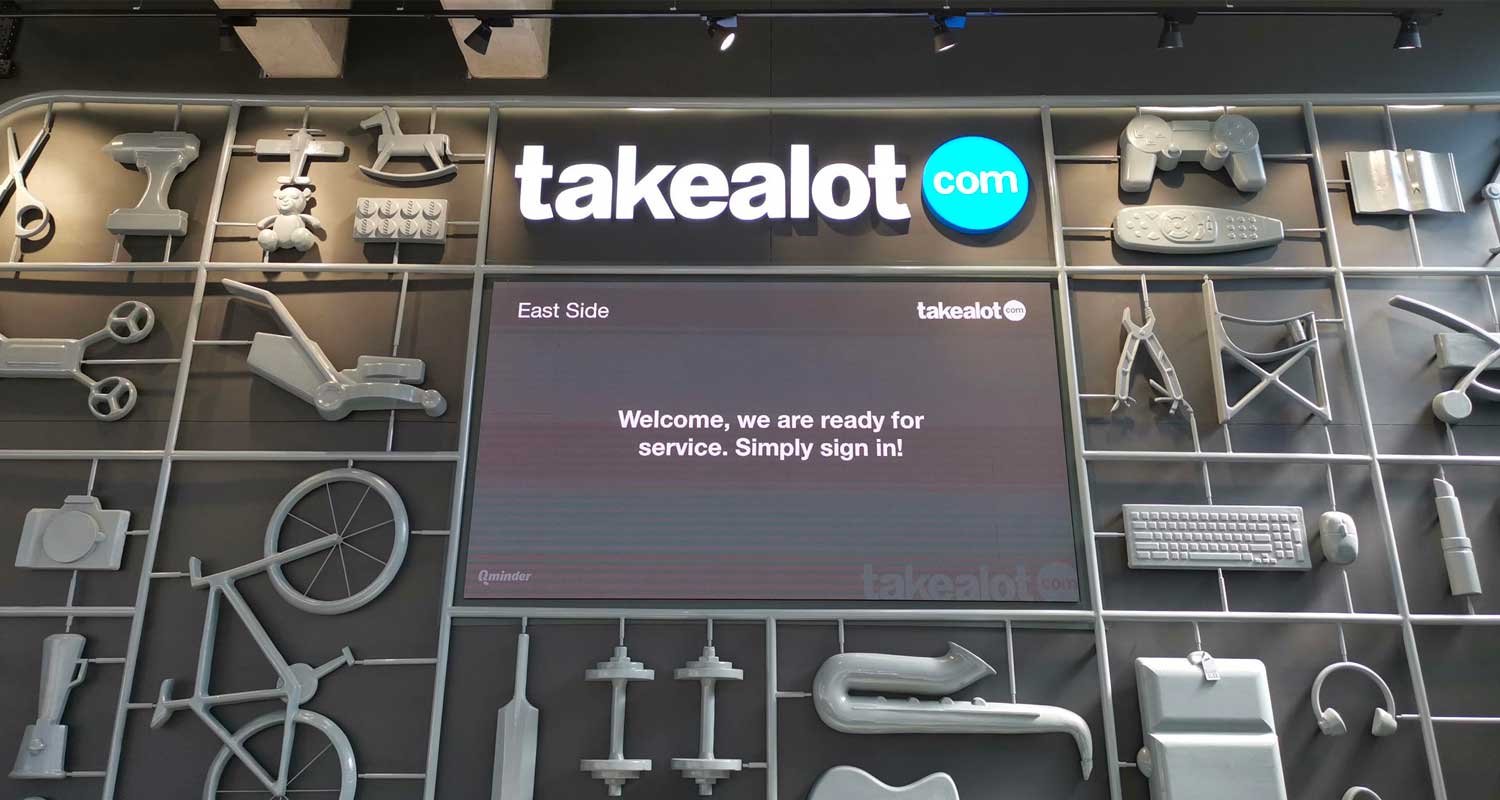

Inside the waiting area of Takealot’s customer collections centre in Midrand, Johannesburg Takealot Group reported a US$13-million interim trading loss for the six months to end-September, parent Naspers said on Wednesday. That translates into a rand loss of R234.9-million using the rand/dollar exchange rate of R18.07 at the close of foreign exchange trading on 30 September – the end of Naspers’s latest six-month reporting period. The loss, which pushed trading margin from -1% a year ago to -3%, came despite a 15% improvement gross merchandise value (GMV) sold and a 13% rise in revenue. First-party retail sales grew 2% while third-party marketplace sales soared by 27%. “Profitability decreased compared with the prior period on higher fuel surcharges, investments in new warehouses and discounted clearance of inventory,” Naspers said in notes alongside its interim results. Takealot’s fashion e-retail business Superbalist grew GMV by 15% in local currency despite increasing competition from brick-and-mortar fashion retailers, the group said. Read: Takealot expands in the townships as Amazon launch nears Mr D, Takealot Group’s delivery business, increased orders and GMV 9% and 13% respectively, “maintaining its strong position in South Africa’s main cities”. Mr D announced a partnership with Pick n Pay in May for grocery deliveries, which commenced in August. Read: Pick n Pay partners with Takealot in online shopping push “In coming months, Mr D will roll out the service across the country,” Naspers said. – (c) 2022 NewsCentral Media Get the latest and best South African tech news